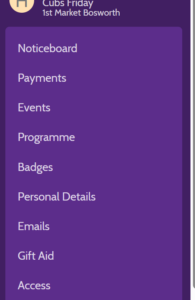

Gift Aid

- For individual donors – You can log into your account on OSM and update Gift Aid declaration and we will do the rest.

- If you trade as a company you can donate using gift aid a different way: You can get your accountant to offset corporate tax by donating to us, please contact them asap to see when you can start/backdate from!

- The money is paid to 1st Market Bosworth Scout Group meaning the likelihood of your own young person benefiting is extremely high.

Long Read

A) For individual donors (you) must:

– have paid at least as much in Income Tax or Capital Gains Tax in that tax year as you want to claim in Gift Aid – (For Example, based our our current annual subs of £127.50 for one young person have you paid more than £26.50 in income tax or capital gains tax.)

– make a Gift Aid declaration that gives you permission to claim it – You can find the declaration within your young persons menu on Online Scout Manager.

B) If you are a company you can donate using gift aid a different way: You get your accountant to offset corporate tax by donating to us!

Chapter 3.12 – When a company makes a qualifying donation to a charity, the amount paid can be set against profits for Corporation Tax purposes. The company can make a claim in its Corporation Tax Self Assessment return to set the amount of the donation against its taxable profits, to the extent that it reduces the chargeable profit to nil. You can make your donation to our Bank account: CAF Bank, 1st Market Bosworth Scout Group, Acc No: 00101204, Sort Code: 40-52-40, please do write and let us know so we can thank you. Read more via this link: https://www.gov.uk/government/

How will my young person benefit from the Scout Group claiming Gift Aid?

1st Market Bosworth Scout Group is a charity in its own right meaning that gift aid money will be paid to our Scout Group and for us (Our Trustees who are local people) to decide how to spend it. Our usual topics to review are: the safety of our premise and equipment, subs v inflation v gift aid, section budgets allowing the young people more resource/adventure, improve hardship/family fund, improve the amount of young people attending events/camps. Please write to me if you have a topic you would like the Trustees to consider.

How much does the Scout Group get?

For individuals we are able to claim 25% on the first £100 of the subs you pay and 5% thereafter up to £2,500. This means of the £127.50 you currently pay annually for your young person to attend Scouts, the Scout Group could get a further £26.50 back from the tax man.

For companies this depends on how much you donate v corporation tax.

Thank you for considering helping us by signing up to GiftAid.

Or Donate now to our Scout Group!